Towards a Japan the World Wants to Visit – An Introduction to the “Departure Tax”

Author

Japan the Tourism Nation

On 28 March 2017 the Japanese government gave Cabinet approval to the “Tourism Nation Promotion Basic Plan”. This policy sets various targets, including 40 million foreign tourists visiting Japan by 2020, and defines the government measures required to achieve them. According to Japan Tourism Agency statistics, the number of foreign visitors to Japan has risen from 19.7 million in 2015, to 24.0 million in 2016 and 28.7 million in 2017, with a further increase anticipated in 2018.

Japan will host the Rugby World Cup in 2019, followed by the much-anticipated Tokyo Olympics in 2020. I hope that the foreign tourists attending these and other events enjoy Japan and become regular visitors.

Establishment of the International Tourist Tax Act

The International Tourist Tax Act was passed by the Diet on 11th April 2018 and promulgated a week later. The law is intended to secure the financial resources required to expand and strengthen the foundations of Japan’s tourism industry in order to realize the goal of Japan as an advanced tourism nation. The label “departure tax” has been used widely in the media, but there is already an “Overseas Relocation Tax System” that is also commonly referred to as a “departure tax”, so caution is required. In this column I will refer to the International Tourist Tax as the “tourist tax” and will present a simple overview of the new law.

Who pays the tourist tax, and how?

Tourists and other people who depart Japan via airplane or ship and meet certain conditions will be obliged to pay the tourist tax, regardless of their nationality. The reason for including “other people” is so that travellers who depart for other purposes such as business or study will also be obliged to pay the tax. However, the following people will not be subject to the tourist tax.

People not subject to the tourist tax

| Class of persons | Status |

| 1. Ship or aircraft crew

2. Deported persons 3. Deep-sea fishermen 4. Persons departing on a government-owned ship or aircraft 5. Persons who return to Japan after departure without entering a foreign country, due to bad weather or other unavoidable reason |

Not taxed |

| 6. Transiting travellers (persons who depart within 24 hours of entering Japan)

7. Persons traveling on an international ship etc. who enter Japan due to bad weather or other unavoidable reason 8. Children under 2 years of age |

Exempt |

Extracted from Question 15 of the National Tax Agency’s Consumption Tax Centre “Q&A About the International Tourist Tax Act” (April 2018)

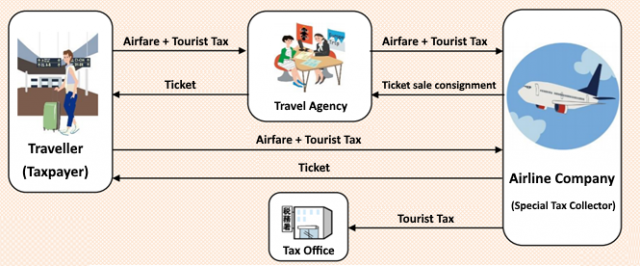

Travellers who are obliged to pay the tourist tax must pay 1,000 yen each time they depart the country, but how will this tax actually be paid? As seen in the diagram below, the government has adopted a method where the tax will be collected by companies operating international passenger transport businesses, such as domestic and foreign airlines and passenger ship companies.

| (Note) International passenger transport business refers to a business that transports passengers for a fee at the request of others using an international ship or other vessel. |

In other words, in principle, the passenger ship company or airline company will add the tax to the price of the ticket and pay the tax to the government. In that sense, the average traveller will not notice that they are paying the tax. But if you are departing Japan on a private jet or yacht you will have to pay the tax directly before boarding, so be careful!

Tourist tax payment method for domestic businesses

Adapted from “An International Tourist Tax will Apply to People Departing Japan from 1st July 2019”, a National Tax Agency leaflet regarding the International Tourist Tax for people departing Japan.

When will the tax take effect?

The tourist tax will apply to people departing Japan on or after 7th January 2019, but people who depart the country under a transport contract that was made prior to that date will not be taxed. However, the tourist tax will apply even though the transport contract was entered into prior to 7th January 2019 if either (1) the contract defines that the tourist tax will be collected separately from the transport fare, or (2) the ticket is an open ticket or multiple-trip ticket that allows travel on or after 7th January.

Handling of tourist tax paid by corporations or sole proprietors

The tourist tax is not an extremely high tax, but for companies or sole proprietors with frequent international travel, the small amount paid each time could add up to a considerable burden over the course of a year. So, how is the tourist tax handled for income tax or company tax purposes?

- If a company pays the tourist tax for an employee’s overseas business trip

-

- Effect on the employee’s income tax

-

-

- If an employee’s departure from Japan is necessary for the conduct of their employer’s business, there will be a tax exemption as a travel expense for the amount equivalent to the tourist tax paid by the company to the employee (Article 9 (1)(iv) of the Income Tax Act).

- If an employee’s departure from Japan is not necessary for the conduct of their employer’s business, the amount of tourist tax paid by the company to the employee will be considered as the employee’s income and subject to income tax

-

b. Effect on the employer’s corporate tax

The amount of tourist tax paid by a company in relation to employee departures may be considered as the payment of travel expenses or transportation costs depending on whether the travel was necessary for the company’s operations, but in all cases, the tax will be included as expenses in the calculation of the company’s income tax.

2. When a sole proprietor pays the tourist tax for an overseas business trip

If a sole proprietor’s departure from Japan is recognized as being directly necessary for the conduct of their business, the tax will be included as a necessary expense in the calculation of their business income. However, if only a portion of the time spent outside of Japan is recognised as being directly necessary for the conduct of their business, then only the proportion of the tax paid that is equivalent to the portion of the travel period directly necessary for the conduct of their business will be included as a necessary expense.

Finally

As the main purpose of this column is for readers to obtain an image of the tourist tax’s application, the legal terminology I have used is a bit ambiguous. Please contact me if you have any questions regarding this column.

(Translated from the original Japanese)

Share

Categories

- Medical & Healthcare

- Tax

- Civil & Family Law

- Maritime and Logistics

- Labour

- International Law

- Corporate

- IT & Intellectual Property

Archives

Recent posts

Tags

- Adultery

- Aging Society

- Brand protection

- CISG

- compliance

- COVID-19

- crisis management

- CSR

- Dementia

- Departure tax

- Disclaimers

- Divorce

- Driving in Japan

- EU law

- Fixed-term contracts

- force majeure

- frustration

- Healthcare

- Inheritance

- International law

- misconduct

- palliative care

- Post-retirement re-employment

- Staff reassignment

- Terminal care

- Torts

- Traffic Accidents